us japan tax treaty protocol 2019

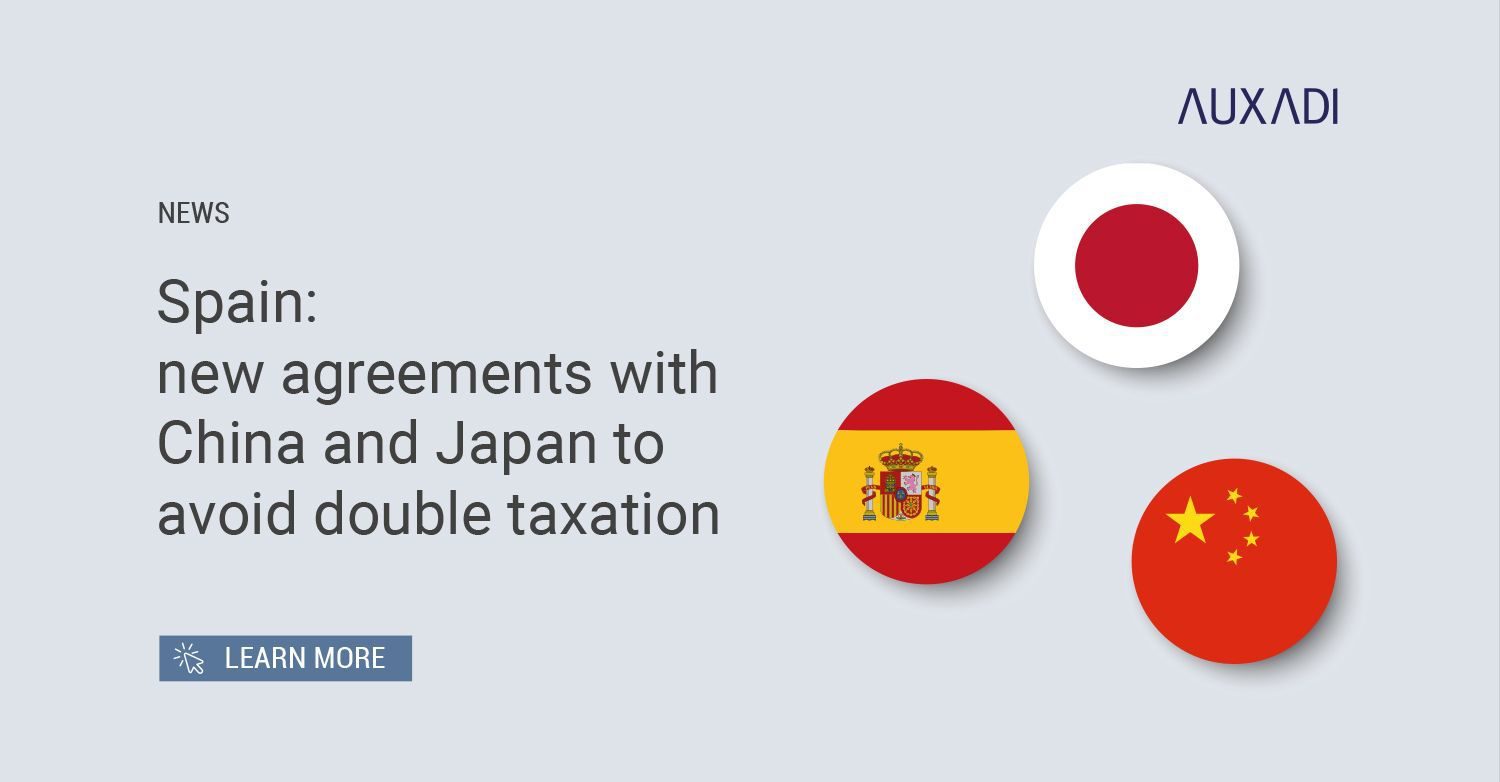

On August 30 2019 the Treasury Department announced the entry-into-force dates of the protocols to the US tax treaties with Japan and Spain. Treasury department announced that protocol amending the convention between the government of the United States of America and the.

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

October 24 2019.

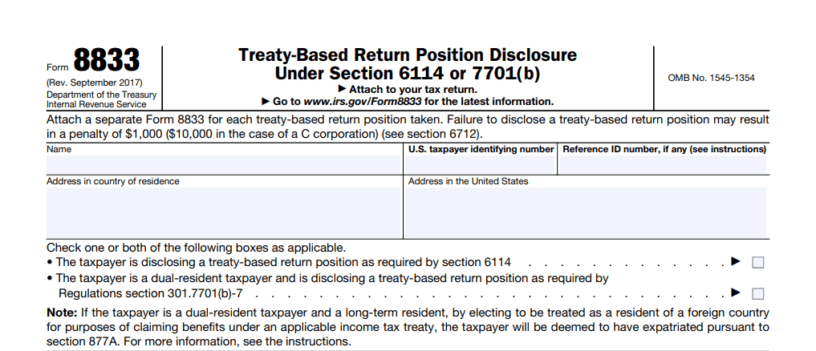

. The instruments of ratification for the Protocol amending the income tax treaty between. On July 16 and 17 2019 the US. As of August 8 2022.

We use cookies to better understand your preferences so that we can bring you the best most personalized experience possible. On 30 August 2019 the US. Tax Conventions principally for the elimination of double taxation and the prevention of tax evasion and avoidance 2.

Prtoocol to income tax treaty between United States and Japan entry into force. The protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or. A protocol to the US-Japan Tax Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of.

Amended Japan-US Tax Treaty Article Posted date 30 August 2019 Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013. The protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or. Treasury Department today announced the entry.

Heres how we use cookies. Under the Protocol Japan is permitted to tax US. Protocol PDF - 2003.

The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and entered into force on 30. Residents on capital gains arising. Income Tax Treaty PDF - 2003.

Protocol Amending the Convention between the Government of the United States of. Senate approved resolutions of ratification of protocols to amend existing income tax treaties between the United States and various. Similarly the Protocol expands Japans taxation rights in respect of real property situated in Japan.

Technical Explanation PDF - 2003. The protocol with Japan entered into. Treasury Announces Action on Tax Protocols with Two Key Trading Partners.

22 rows The Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation.

U S Updates Tax Treaty Protocols With Japan And Spain Accounting Today

Surprisingly Good Irs Apa Annual Report With Strong U S Japan Results

Multilateral Instrument To Curb Tax Treaty Abuse Times Of India

Spanish Taxes For Us Expats Htj Tax

Archived Gir News And Views Deloitte Us

Changes To The Us Japan Tax Treaty International Tax Accountant

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

New Tax Treaty With Japan Will Apply As From 1 January 2020

Spanish Taxes For Us Expats Htj Tax

The Tax Treaty Protocol Signed Between Spain And The United States Rsm Spain

Forum A Look At The Amended Japan U S Tax Treaty

European Tax Treaties Tax Treaty Network Of European Countries

As Nations Look To Tax Tech Firms U S Scrambles To Broker A Deal The New York Times

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

Tax Free Withdrawal Of U S Based Retirement Funds By Non U S Citizen Australians

American Expatriate Tax Understanding Tax Treaties

Spain New Agreements With China And Japan To Avoid Double Taxation Auxadi